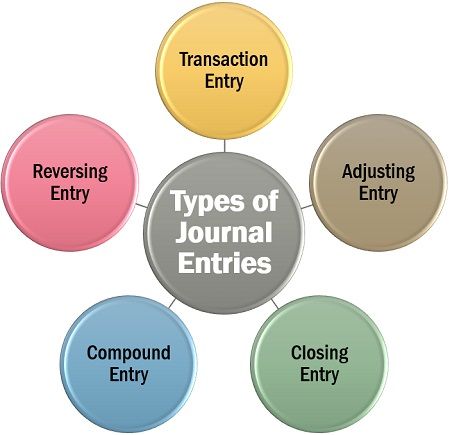

Moreover, we’ll provide a practical journal entry example and introduce a neater method to simplify the process. This account shows the total amount of cash the company has raised by selling shares. When the corporate issues shares, it’s recorded as a credit to the Capital Stock account.

You can fall back on them when it comes to funds since they’re very well-organized, categorized, and balanced. Each types of financial data are important for monetary accounting. Whether you’re doing it your self or working with an accountant, stable entries make everything quicker, clearer, and fewer stressful. Especially within the United States, where revenue tax requirements differ by time period, business kind, and deductions claimed. When you first arrange your books or start a model new fiscal 12 months, you’ll create a gap entry to replicate your starting balances — things like belongings, liabilities, and equity.

While some firms might need more specialty journals, these four are the commonest workhorses of the accounting world. For each dollar that is obtainable in, a dollar should be recorded elsewhere. No matter how many accounts are concerned, the total debits should always equal the total credits.

Retain journal entries and supporting documentation for a minimal of seven years, or as required by native laws, to ensure full auditability and regulatory compliance. Osfin can ingest any transaction information in close to real-time in any format utilizing its 170+ pre-built integrations across banks, ERPs, PSPs, wallets, lending platforms, and inside systems. As a file-format-agnostic platform, Osfin applies customized deviation tolerances, detects mismatched or duplicated entries at ingestion, and ensures solely clean, high-quality data flows downstream. Match your journal entry log to the ledger on a daily schedule instead of getting to it during the month-end. Day By Day reconciliation helps you catch gaps, duplications or lacking approvals earlier than they cause closing delays or reporting risk. Transfer all journal entries whether or not they are open, posted, or exceptions into a single, always-updated register.

- If you spend cash, say on provides, you lower (credit) your cash account.

- If the company makes a profit, it’s a credit to Retained Earnings.

- Manual journal entry processes are subject to errors that may disrupt financial accuracy and create compliance complications even for knowledgeable groups.

- Analyze accounts for accruals, deferrals and estimates, then report the necessary changes in your accounting system to ensure correct monetary reporting.

- LiveCube additional allows users to do a one time arrange automation for journal entry postings.

Importance Of Adjusting Journal Entries

This could presumably be bills which have constructed up but haven’t been paid but (accrued liabilities) or sales that were made but not but paid for (accounts receivable). These entries help ensure the financial statements replicate the actual situation, like adjusting for unhealthy debt or recording depreciation on tools. Using accounting software program for journal entries comes with many advantages. It makes recording transactions sooner and extra accurate, helps in monitoring the monetary health of your small business in real-time, and simplifies creating financial reports.

How Can All Kinds Of Accounting Journal Entries Improve Transparency In Monetary Reporting?

Visualize the way your cash strikes, and move your small business like an professional. HighRadius is redefining treasury with AI-driven tools like LiveCube for predictive forecasting and no-code state of affairs constructing. Its Money Management module automates bank integration, world visibility, money positioning, target balances, and reconciliation—streamlining end-to-end treasury operations. If you aren’t yet acquainted with the accounting elements and how each they work, see our lesson about Fundamental Accounting Ideas here.

Before we jump into a sea of accounting journal entry examples, let’s first perceive the craft behind them. Before she casts a single thread, she should know its fiber and its destined place within the grand design. Alright, let’s get into the nitty-gritty of the way to make journal entries. Except, as an alternative of writing about its crush, it’s meticulously logging each greenback that comes in or goes out.

Tips For Higher Journal Entry Practices

Nevertheless, reversing ought to be accomplished fastidiously to keep away from creating new errors. By recording all types of accounting journal entries—standard, adjusting, and closing—companies create a full picture of their financial health. This detailed recordkeeping increases transparency, reduces audit risks, and provides management with actionable insights. Standard journal entries are used to initially report transactions within the books as they occur.

Monitor your earnings and bills and immediately know your backside line. You need to ensure you enter the sales transactions into the income sheet. Used for regular transactions like rent, depreciation, or loan interest. Discovering an accountant to handle your bookkeeping and file taxes is a giant determination. Now, let’s get our hands soiled with some follow, seeing how all this concept works in real life with some common examples. Journal entries are like the different brushes an artist makes use of to color an image, each one serving a particular https://www.simple-accounting.org/ objective in the masterpiece of accounting.

Set notifications for exceptions such as large entries, odd timing, or account combos that don’t match ordinary patterns. All The Time track who made adjustments and when together with audit logs that keep the ownership historical past clear to support compliance and operational checks. In the expense journal, we record a debit for the amount that went in path of interest individually from the quantity that reduces the stability. You’re going to fulfill up with a shopper, choose up some office provides, and cease by the financial institution to make a loan fee. Suppose of the double-entry bookkeeping methodology as a GPS displaying you each your origin and your destination.

Leave a Reply