To study extra about how your state revenue tax rates work, visit your state’s taxation and income department website. Capital positive aspects in Oregon are subject to the conventional personal revenue tax rates. That means capital gains may be taxed at a price as high as 9.9%, depending on your complete revenue. When calculating personal revenue taxes, Oregon depends closely on the federal income tax structure. Oregon taxable revenue is equal to federal taxable earnings, with a restricted variety of additions and subtractions.

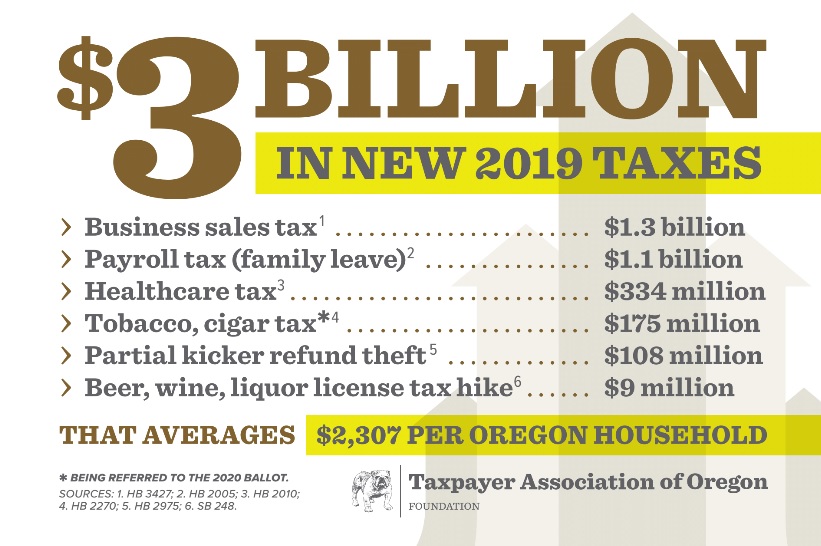

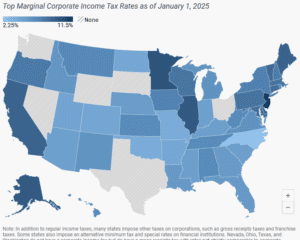

This system of contributions not solely ensures the continued viability of those programs but additionally directly ties the advantages a person receives in retirement or in periods of incapacity to their work historical past and contributions over their working life. As such, FICA represents a crucial element of the Usa’ strategy to social welfare, offering foundational financial safety and healthcare benefits that many Americans depend on. Forty-four states levy a company income tax, with high rates ranging from a 2.25 percent flat fee in North Carolina to a 11.5 percent high marginal fee in New Jersey.

This reduces the taxable revenue for the yr, potentially resulting in decrease tax liabilities. Moreover, the funds in these retirement accounts grow tax-deferred, which means that taxes on funding gains usually are not https://www.intuit-payroll.org/ paid until the money is withdrawn throughout retirement, ideally at a decrease tax rate. The City of Portland’s enterprise license tax operates equally to Multnomah County’s business earnings tax, likewise levied on the net income of partnerships, S corporations, and C firms. For Portland businesses, it’s along with the county’s tax, and is imposed at the next price of two.6 %. As with the business earnings tax, there could be an adjustment to avoid double taxation of the identical business revenue under the tax.

Payroll

- In all combination fee calculations that include the CAT on this publication, we are going to use the estimate of a 6.72 % net earnings equivalent.

- Like the Federal Revenue Tax, Oregon’s earnings tax permits couples filing collectively to pay a decrease total fee on their mixed income with wider tax brackets for joint filers.

- This signifies that, on common, taxpayers pay about 6% of their revenue in state taxes, although the exact quantity is dependent upon earnings degree and eligibility for deductions.

- Whereas no class of earnings has all 9 taxes imposed on it, every taxpayer faces a number of layers.

The State Tax Competitiveness Index enables policymakers, taxpayers, and business leaders to gauge how their states’ tax systems compare. While there are numerous ways to point out how a lot state governments acquire in taxes, the Index evaluates how well states construction their tax systems and supplies a highway map for improvement. Oregon doesn’t acquire sales taxes of any sort, at the state or native degree. To e-file your Oregon and Federal revenue tax returns, you want a bit of tax software program that is certified for eFile by the IRS.

Tax collections are managed primarily by the 36 counties in Oregon, which assess property and calculate taxes owed. Income from the property tax typically goes to support native providers similar to colleges and legislation enforcement. Only Hawaii, with a $200,000 top bracket, is within the ballpark of Oregon’s. In this information, we’ll explore key parts of The Beaver State’s tax system, from earnings and sales taxes to property taxes and retirement benefits.

Total Tax Burden

That stated, the table below displays the state tax charges, average local tax charges, and common combined tax charges for Oregon and its neighboring states. In Distinction To tax charges, which differ broadly based on an individual’s circumstances, tax burden measures the proportion of whole personal income that residents pay toward state and local taxes, based on WalletHub. The IRS Free File program is a Public-Private Partnership (PPP) between the IRS and the Free File Alliance, a coalition of leading tax preparation software program firms. The IRS Free File program PPP isn’t a standard contractual arrangement; this partnership represents a stability of joint accountability and collaboration that serves the interests of taxpayers and the Federal authorities. The online tax preparation software program companions are part of the Free File Alliance, which coordinates with the IRS to supply free electronic federal tax preparation and submitting to you. This non-profit, public-private partnership is dedicated to helping hundreds of thousands of individuals prepare and file their federal taxes on-line for free.

In Oregon, the common property tax fee as a percentage of assessed house value is zero.77% according to the Tax Basis. Oregon’s revenue tax brackets are excessive in comparison with most different states, and the state taxes most types of retirement earnings. Oregon’s state earnings tax charges and brackets for 2025 stay secure, with 4 progressive brackets ranging from 4.75% to 9.9%. The lack of a common sales tax means that earnings tax is the primary state tax burden, making it essential for residents, immigrants, and newcomers to know their obligations.

The EITC rates and thresholds are adjusted annually to mirror changes in the financial system and value of living. For the tax yr 2026, these changes make sure that the credit stays aligned with the present financial situations, providing focused help to eligible taxpayers. Understanding the newest EITC rates and thresholds is essential for taxpayers who wish to maximize their potential credit score and precisely plan their finances.

Oregon has $10,214 in state and local debt per capita and has an 88 percent funded ratio of public pension plans. Oregon’s tax system ranks thirtieth general on the 2025 State Tax Competitiveness Index. Statewide, the common effective property tax price (annual property taxes as a percentage of house value) is zero.86%. As A Outcome Of of the inherently local nature of property tax collections in Oregon, rates differ considerably between counties. While not all small companies are pass-through entities, and not all pass-throughs are small, the overwhelming majority of small companies are organized as S firms, partnerships, LLCs, and sole proprietorships.

It’s necessary to evaluation the Oregon Department of Revenue’s guidance or consult a tax skilled to ensure all relevant adjustments are made. For detailed directions, taxpayers can refer to Oregon’s Publication OR-17. Oregon’s greater price of living just isn’t only attributable to the value of shelter which is 20% costlier than the 50-state average but additionally attributable to the price of items which are 7% costlier than the 50-state common. In its latest reporting, as written in my current Catalyst article, the BEA also ranks Oregon as having the eighth highest value of dwelling among the 50 U.S states. DonateAs a nonprofit, we rely on the generosity of people such as you.

Leave a Reply