If paying worldwide workers becomes essential, consider additional providers to accommodate this want. QuickBooks On-line Payroll doesn’t just cease at adding employees – it additionally provides you the tools to handle them successfully. Plus, QuickBooks stores this info securely, so your data is at all times protected. On the payroll dashboard, QuickBooks intuitively presents key tasks proper in the front. It Is designed to maintain every thing in plain view, making your duties simpler to handle. Whichever methodology you select, make certain payments are well timed and accurate to maintain your workers joyful.

Adding Employees To Quickbooks Payroll

Your country’s labour legal guidelines might determine extra time pay rates and requirements for your workforce. You’ve journeyed via the necessities of QuickBooks Online Payroll, from setup all the best way to operating and monitoring payroll. While it might really feel like so much at first, keep in thoughts that every step makes the method less complicated and extra environment friendly. By taking the time to set up accurately and familiarize your self with the system, you will discover payroll administration becomes a stress-free endeavor. After adding your financial institution details, setting your payroll preferences is subsequent on the agenda. This includes deciding on pay schedules, employee pay sorts, and more.

Whether Or Not you are a veteran in enterprise or a latest startup, establishing cost schedules can often really feel like threading a needle. You begin by choosing how usually you need to pay your workers – weekly, bi-weekly, or month-to-month. The software provides flexibility, so select whatever schedule suits you greatest. So, you’ve determined to streamline your payroll process utilizing QuickBooks Online Payroll – a wonderful choice! Getting began might seem a bit overwhelming, however once you’re up and working, you’ll see it’s a breeze.

- Based Mostly on an Intuit survey of 2040 QuickBooks On-line Payroll customers in February 2023.

- When processing payroll, the tax burden is cut up evenly between employer and worker.

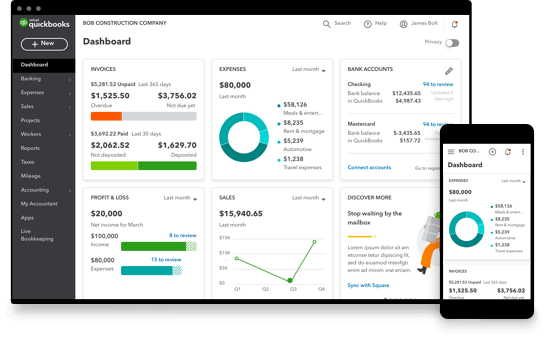

- Learn the means to get set up, pay your staff, discover HRsupport and advantages, and sync with accounting soyou can handle everything in a single place.

- If you hit a snag, QuickBooks presents glorious support options, including chat and phone help.

- QuickBooks Online Payroll would not just cease at adding staff – it also offers you the instruments to handle them effectively.

In this task, you’ll connect your payroll bank account so you ought to use direct deposit and we will pay and file your payroll taxes. You might find a way to connect it immediately so you have to use direct deposit instantly. With QuickBooks Payroll, you can set payroll to run with alerts and notifications. Automate payroll tax varieties and filing so you will never get caught off guard again.

Baby assist is a deduction taken from wages regarding child support funds paid across to Providers Australia. When deducting baby assist there’s a portion of the employee’s wages which are a Protected Earnings Quantity (PEA) and are exempt from withholding. You might need to have the details of the employee’s bank account for electronic https://www.simple-accounting.org/ payment of their wages. You have the choice in payroll to separate payment throughout a number of bank accounts if the worker needs. At this point, it’s value noting a potential source of confusion. Some US sources discuss ‘withholding’ payroll tax as if it’s a separate factor.

Does Quickbooks Payroll Do Direct Deposit?

There are few one-and-done duties when you suppose about the way to manage payroll for a small business, as a result of it’s an ongoing duty. However with the best techniques in place, managing payroll can really feel less like a chore and more like a seamless part of working your small business. By understanding FICA taxes, you’ll find a way to ensure correct withholdings and keep away from costly mistakes. These contributions assist fund important benefits for employees, so it’s value getting them right. Sure, QuickBooks Payroll integrates with many HR software platforms.

With payroll software program, you can focus on growing your small business as a substitute of stressing over compliance. It’s a small funding that pays off big in peace of mind and effectivity. All three service plans (Core, Premium, and Elite Payrolls) give the free direct deposit. It will turn into straightforward for employers to pay their workers, who’re already present in the application. With the help of QB payroll, It is easy to arrange and handle employees’ info as required by employers and tax authorities. As a result, administrative duties like these require fewer staff.

You can determine an employee’s gross pay using their pay rate and your scheduled pay durations. Most generally, pay durations are weekly, every two weeks, or monthly. Payroll taxes could check with Social Insurance Coverage or state health insurance taxes, depending on the country you’re primarily based on. Deductions are any quantity removed from an employee’s paycheque for tax or different purposes. Widespread deductions embrace payroll taxes, payroll withholdings, wage garnishments, and benefit deductions.

There’s a growing development of companies hiring fewer employees, generally only one. If you’re wondering tips on how to set up payroll for one worker, we’re happy to report that there’s no actual difference in the procedure. Some states have their own variations of the W-4, so ensure you’re aware of any additional necessities in your space. Filling out this type correctly ensures that your employees’ tax withholdings align with their monetary conditions and helps you avoid penalties for under- or over-withholding.

In the Shared information part, choose the pencil and uncheck the box. QuickBooks Payroll now contains group management tools so you presumably can streamline your HR duties and save valuable time. From uploading and sharing documents to requesting e-signature and automating l-9 compliance, do it all from one easy-to-use platform. Learn the means to get set up, pay your group, discover HRsupport and advantages, and sync with accounting soyou can manage everything in one place. All The Time maintain detailed records on your payroll process and worker paycheques. Correct recordkeeping can protect your small business within the event of a tax audit, or other labour lawsuits.

In some cases, the HR division enters worker info and finance or accounts payable runs the numbers and pays employees. If you’re hiring contractors or staff, you’ll want to know what makes them totally different and the way employment taxes work. Included with QuickBooks Enterprise Gold and Platinum, QuickBooks Desktop Enhanced Payroll gives you the instruments to create paychecks and shortly file taxes your self. As we’ve said a quantity of times, it can be tough to work out all of the different deductions for each of your individual workers. The ATO helpfully offers a quantity of tax withheld calculators. Consider the steps beneath to make certain you are compliant with PAYG withholding.

Leave a Reply